Track and Manage Your Income and Expenses Easily

Managing your finances can be challenging, but our app helps you track your income and expenses seamlessly. Stay on top of your finances with real-time tracking.

How Our App Helps You

Our app offers a comprehensive solution to track all your expenses, visualize spending patterns, and plan your budget. Get insights to save money and stay financially healthy!

Track Expenses

Monitor all your daily, weekly, and monthly expenses in one place with intuitive categories.

Manage Budgets

Set financial goals and track your progress with customizable budget categories.

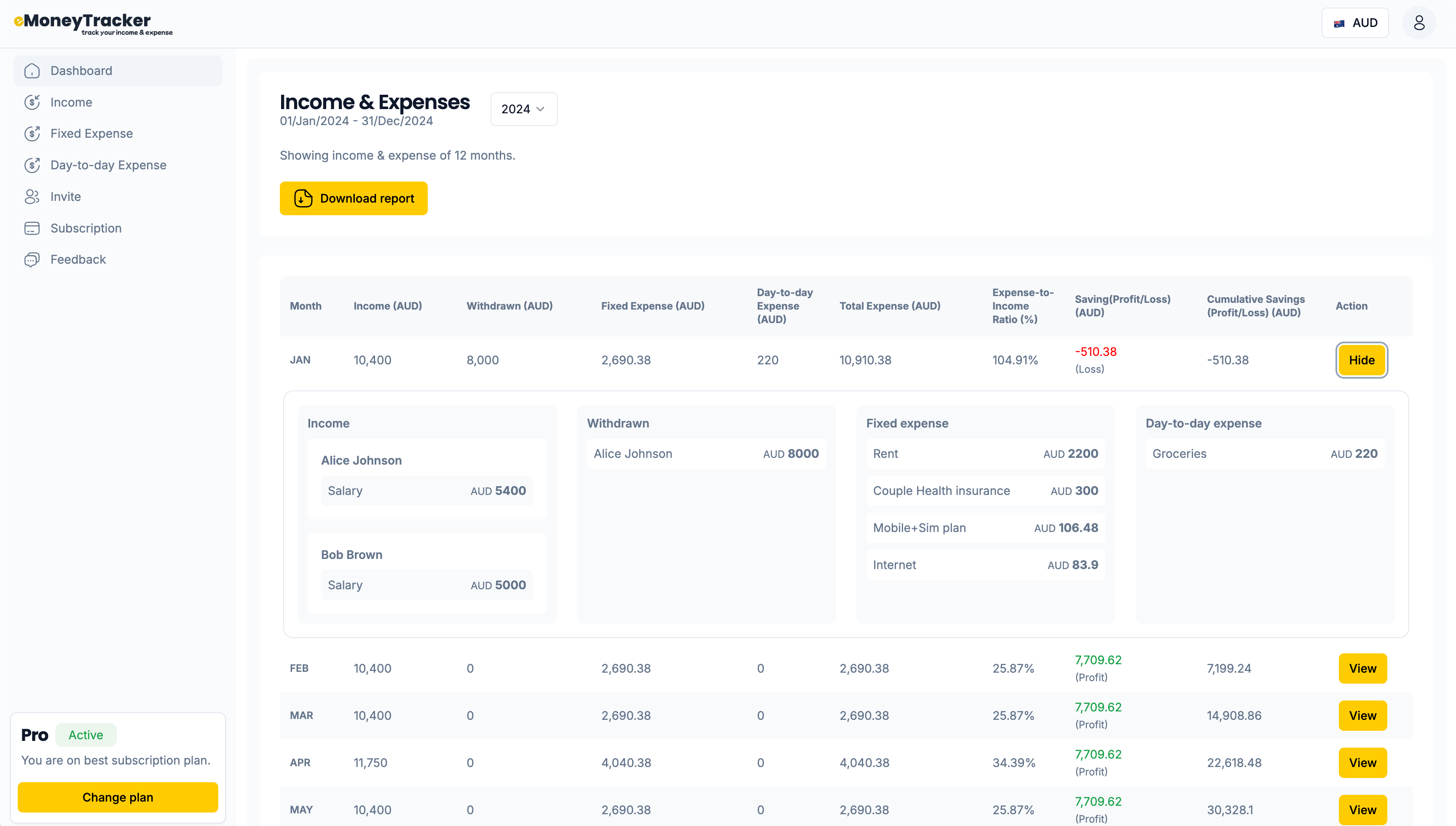

Financial Insights

Get detailed reports and analytics to understand your spending patterns.

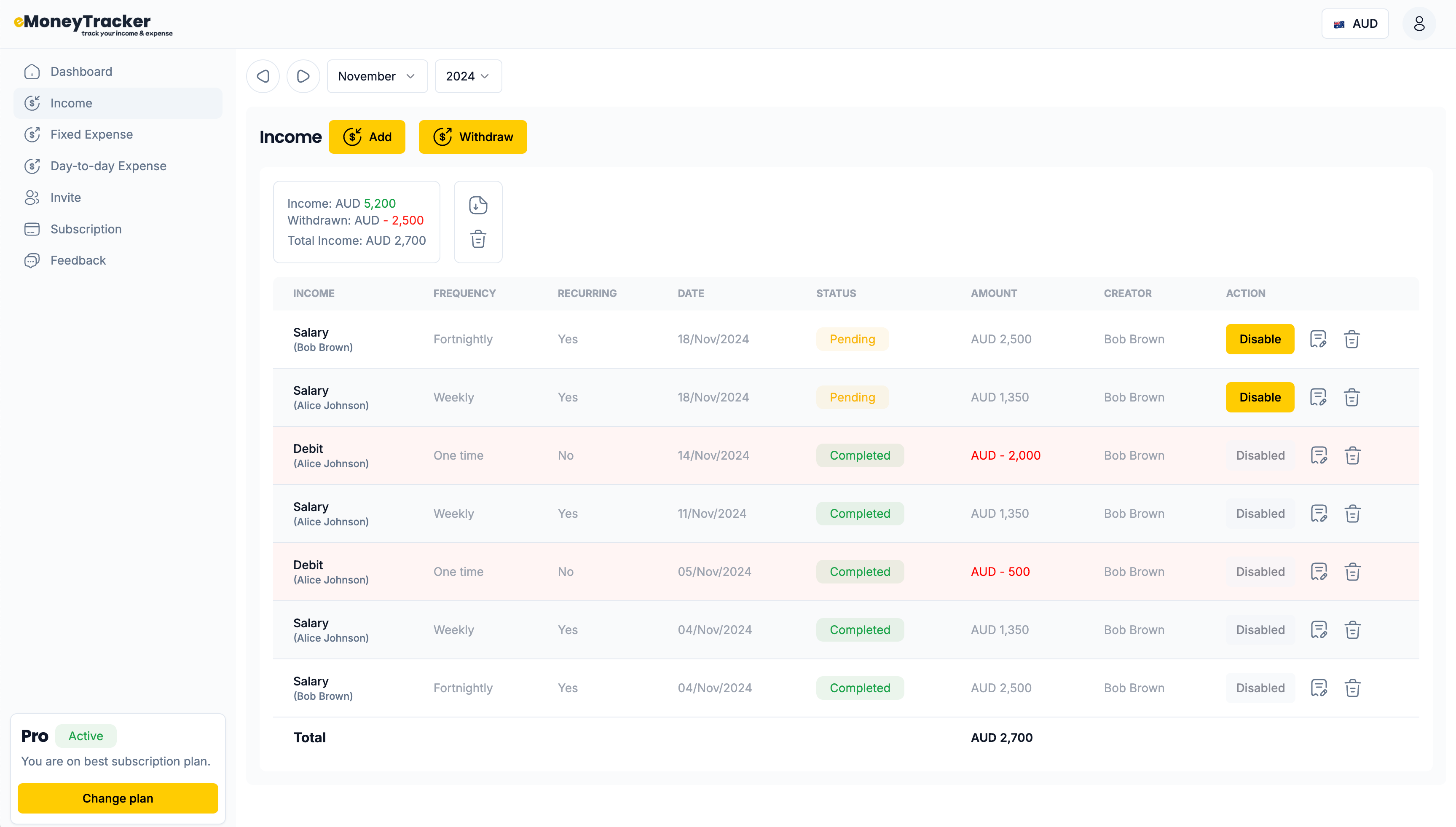

Income Entry

Income refers to the money you regularly receive from various sources. Tracking income helps manage finances and plan for expenses and savings.

Examples of Income Sources:

- Salary or wages

- Freelance or side business earnings

- Investment returns (dividends, interest)

- Rental income

Steps to follow:

- Identify Income Sources: List all the consistent income streams.

- Enter the Amount: Input the exact amount received for each income source.

- Set Income Frequency: Choose how often you receive the income (monthly, weekly, etc.).

- Save the Income: The system will automatically track your earnings.

Make sure to review and update if any changes occur (e.g., new income streams or changes in amounts).This helps keep your income organized and up to date.

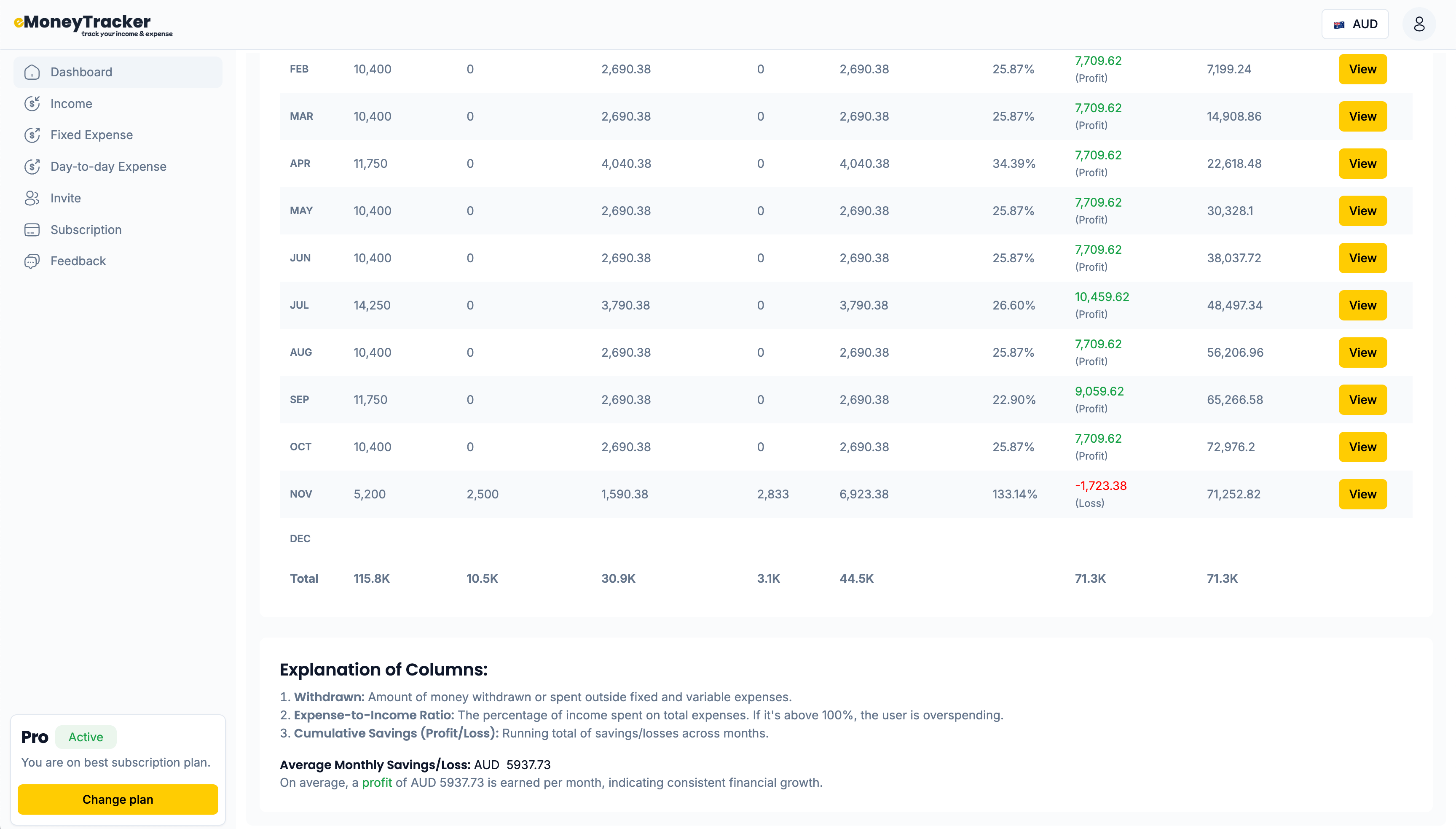

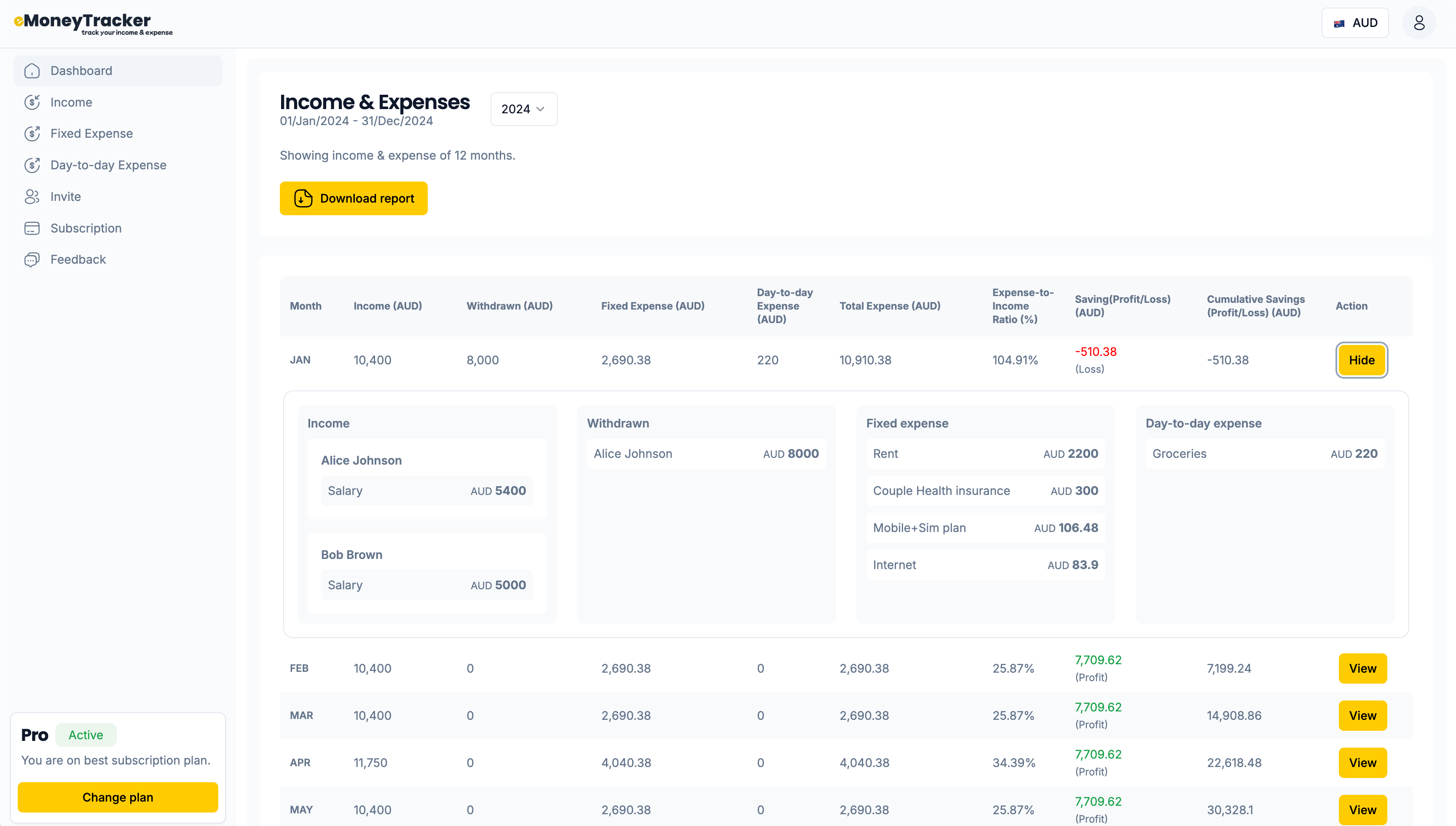

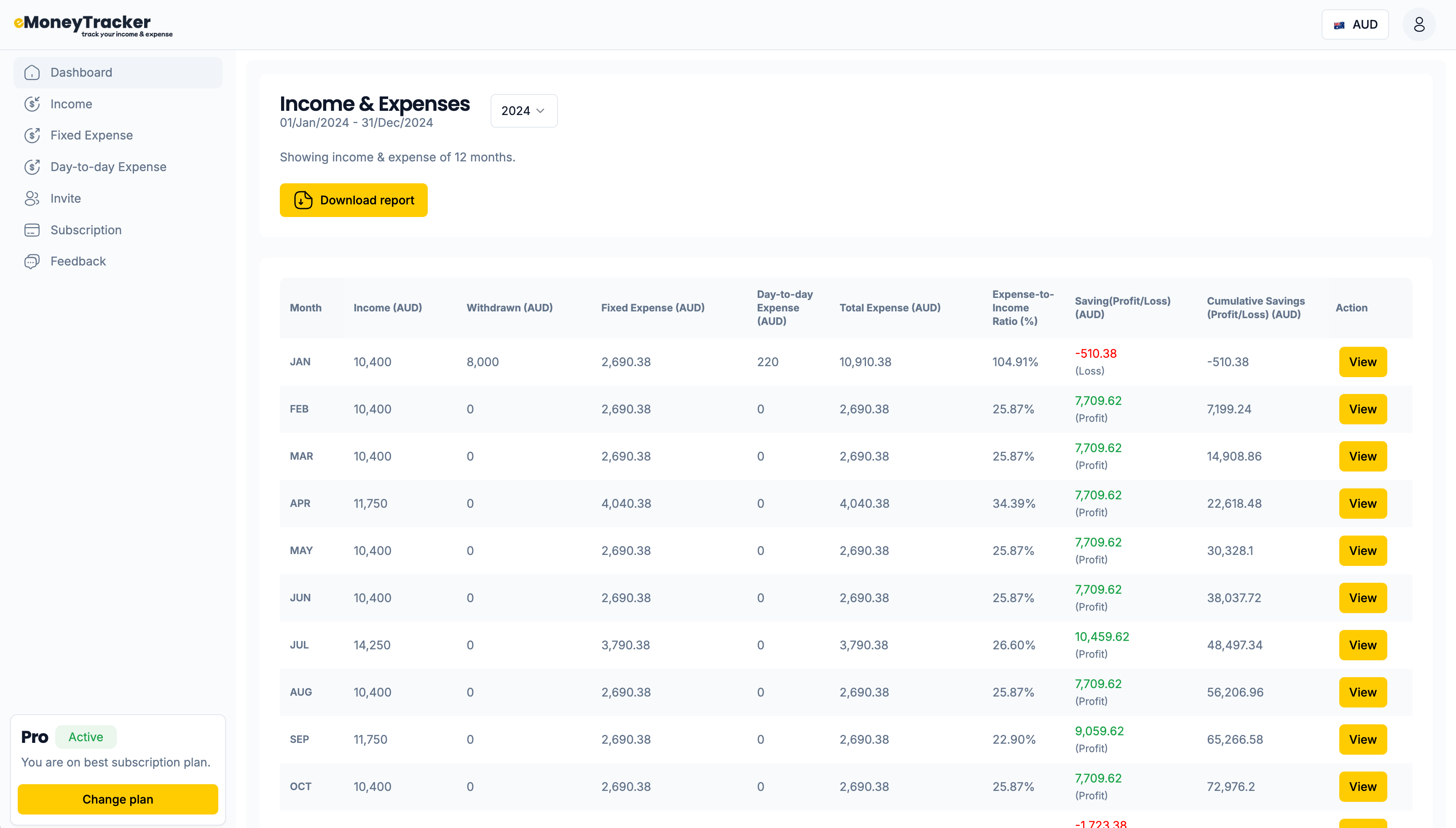

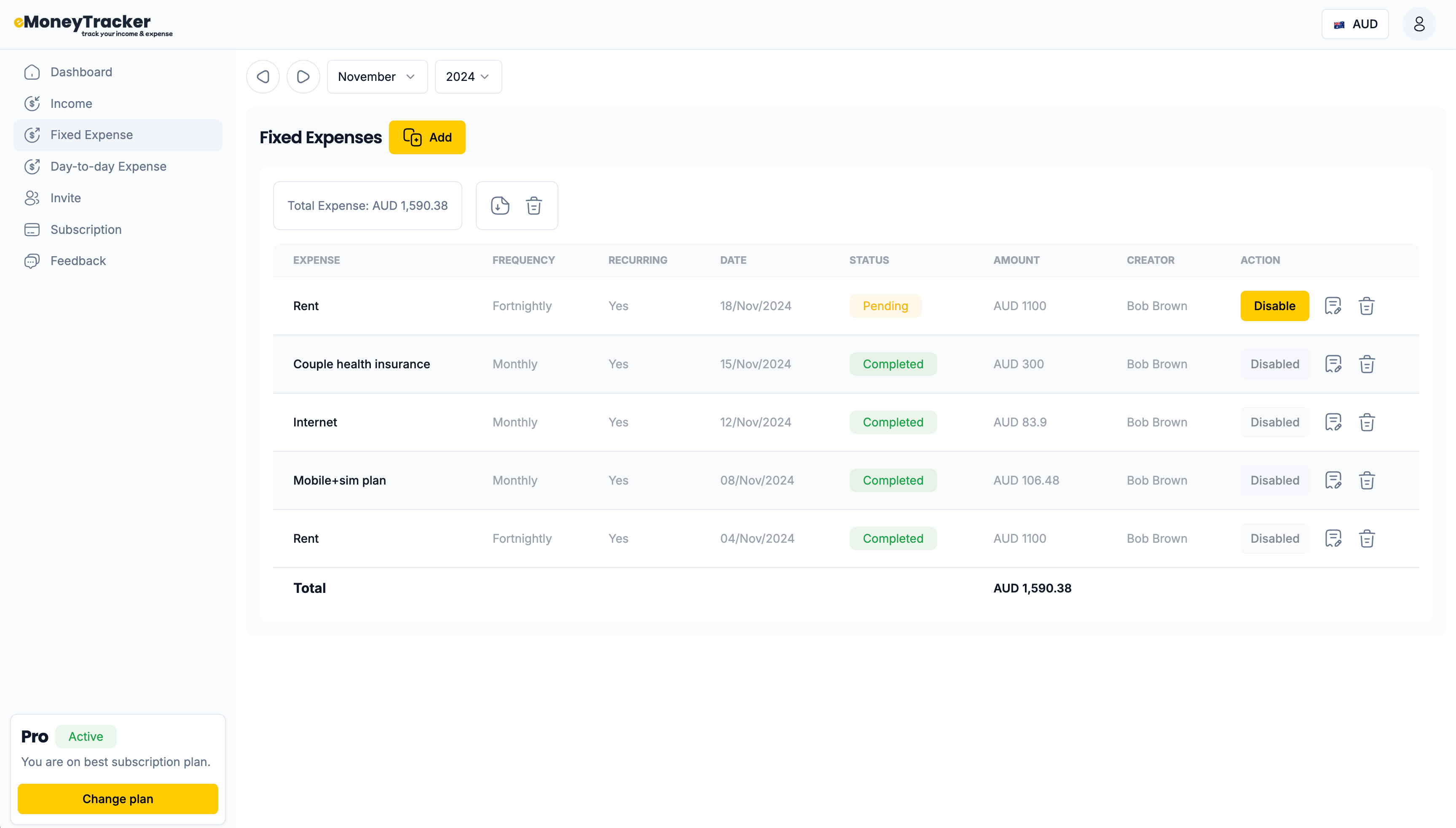

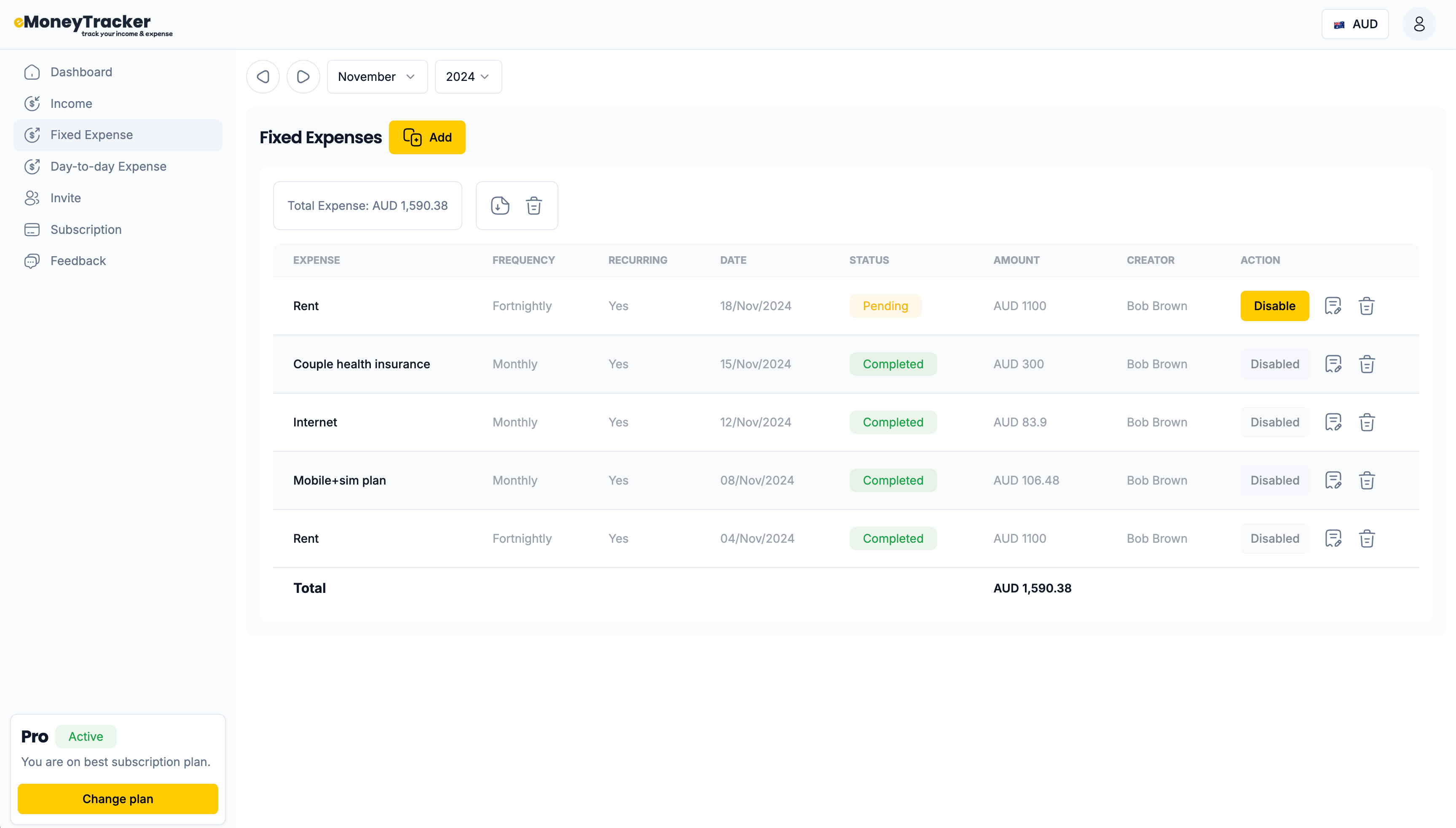

Managing Fixed Expenses

In this section, you will enter fixed expenses, which are costs that stay consistent over time. These are payments where the amount does not change, and you know exactly how much you need to pay each month or billing cycle.

Examples of Fixed Expenses include:

- Rent or Mortgage payments

- Insurance premiums (Health, Car, Life, etc.)

- Subscription services (Netflix, Gym, etc.)

- Loan repayments (Student loan, Car loan, etc.)

Steps to follow:

- Identify your fixed expenses: List all the payments that remain the same every period.

- Enter the amount: Input the exact amount you need to pay for each fixed expense.

- Set the payment frequency: Select how often you make the payment (e.g., monthly, quarterly).

- Save the expense: Once entered, the system will automatically track these payments for you.

Make sure to review and update if any changes occur (e.g., new subscriptions or changes in loan rates).

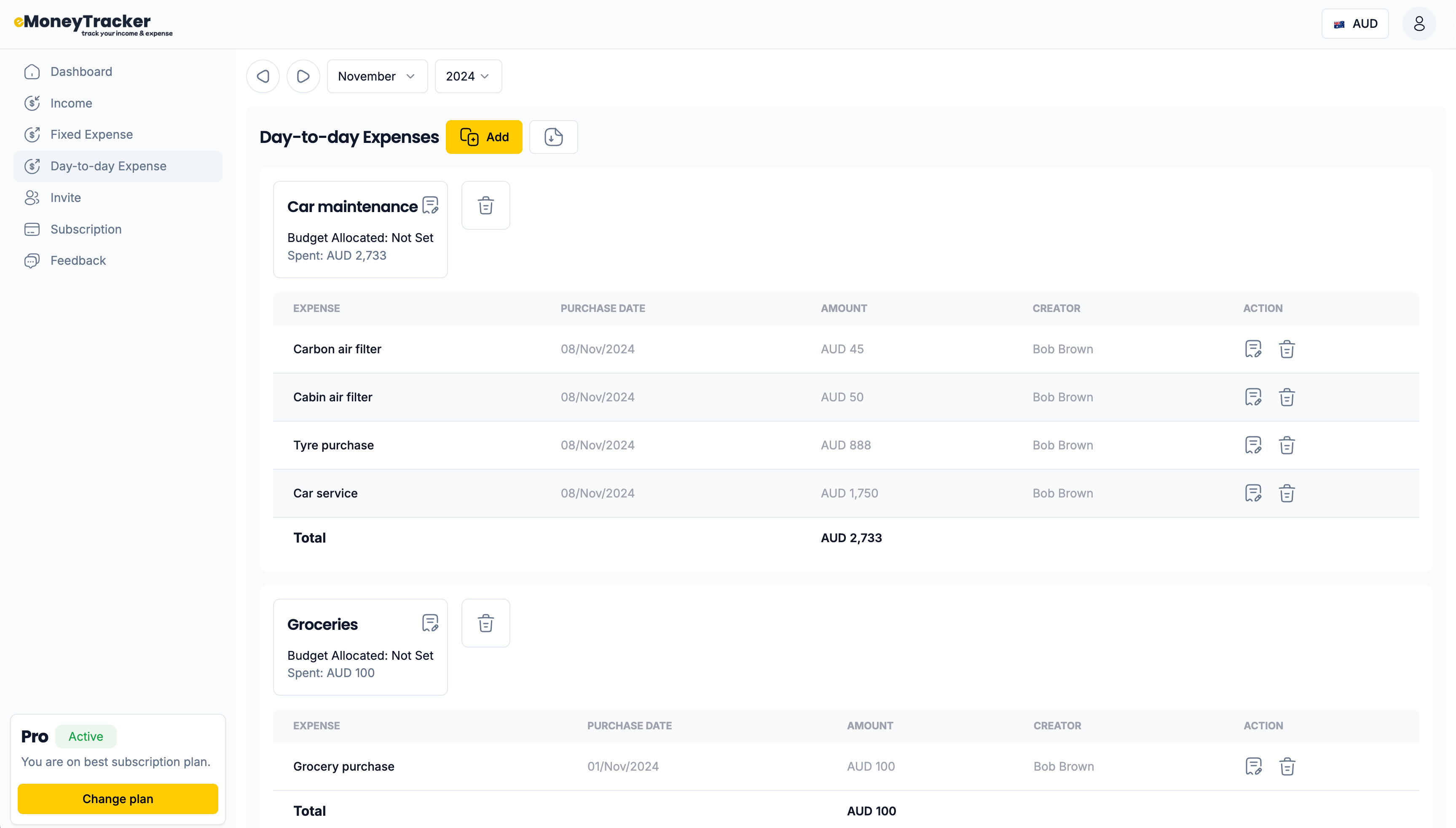

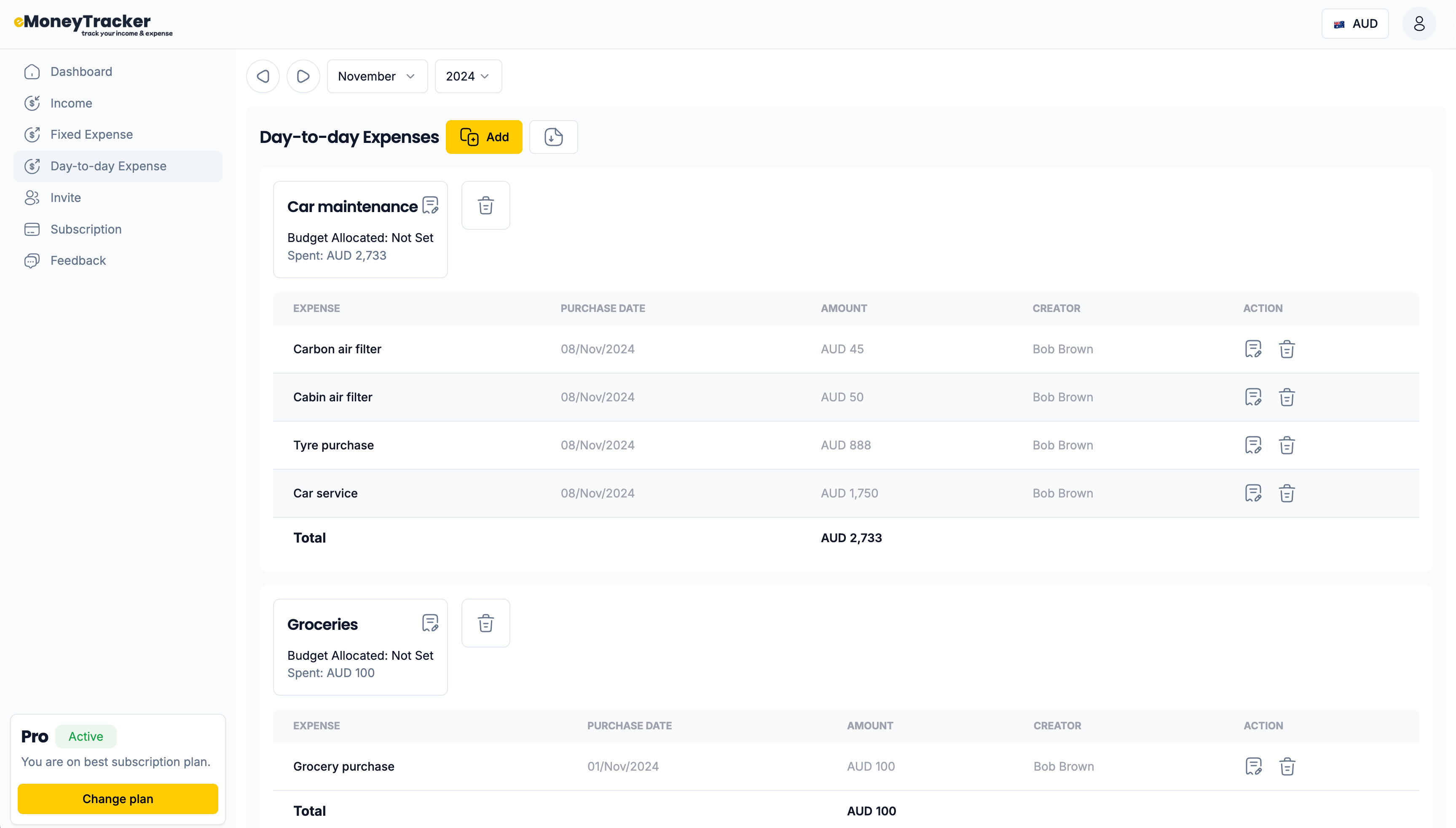

Managing Day-to-Day Expenses

In this section, you will enter day-to-day expenses, which are costs that can vary from month to month. These expenses are necessary for your daily living and can change based on your consumption and lifestyle choices.

Examples of Day-to-Day Expenses include:

- Groceries

- Transportation costs (fuel, public transit)

- Dining out or takeout

- Utility bills (electricity, water)

- Entertainment expenses (movies, subscriptions)

Steps to follow:

- Identify your day-to-day expenses: List all the variable costs you incur regularly.

- Enter the amount: Input the amount spent for each expense during the month.

- Save the expense: Once entered, the system will track these variable costs for you.

Be sure to review your expenses regularly to adjust your budget and spending habits as needed.

Simple, Transparent Pricing

Choose the plan that best fits your needs. All plans include core features to help you manage your finances effectively.

90 Day Free Trail

Try for free

- Unlimited income tracking

- Unlimited fixed expense tracking

- Unlimited day-to-day expense tracking

- Multi-device sync

- Multi-User collaboration

- Data export

- Unlimited log history

Basic

Free forever

- Limited income tracking

- Limited fixed expense tracking

- Limited day-to-day expense tracking

- Multi-device sync

- No multi-User collaboration

- Data export

- Limited log history

Pro

Everything you need

- Unlimited income tracking

- Unlimited fixed expense tracking

- Unlimited day-to-day expense tracking

- Multi-device sync

- Multi-User collaboration

- Data export

- Unlimited log history